Compare Business Formation Structures

The business structure you choose affects everything from how much you pay in taxes to whether your personal savings are protected if something goes wrong. It's one of the first decisions you'll make as a founder—and one of the most consequential, a choice that 5.1 million new businesses faced in 2025 alone.

We break down the four main business formation structures, compare them side by side, and walk you through how to pick the right one for your situation.

What is a business formation structure

Your business formation structure is the legal framework that shapes how your company operates, pays taxes, and protects you from personal liability. Think of it as the foundation your business sits on—it determines whether you and your business are legally the same thing or separate entities entirely.

This decision affects three big areas of your business life. First, it determines your tax treatment: whether profits pass through to your personal return or get taxed at the corporate level. Second, it defines your liability exposure: how much of your personal savings, home, or car could be at risk if your business gets sued or can't pay its debts. Third, it sets your compliance requirements: the paperwork, filings, and formalities you'll handle year after year.

- Legal identity: Whether your business exists separately from you as a person

- Tax treatment: How profits get taxed at federal and state levels

- Liability protection: Your personal responsibility for business debts and lawsuits

- Operational requirements: Ongoing compliance, annual reports, and record-keeping

Types of business structures and entities

The four main business structures in the U.S. are sole proprietorships, partnerships, LLCs, and corporations. Each one handles liability, taxes, and management differently.

Here's a quick comparison to help you see the landscape:

| Structure Type | Liability Protection | Tax Treatment | Best For |

|---|---|---|---|

| Sole Proprietorship | None | Personal | Solo freelancers, low-risk ventures |

| Partnership | Varies by type | Pass-through | Multiple owners sharing management |

| LLC | Yes | Flexible | Small businesses wanting protection |

| Corporation | Yes | Corporate or pass-through | Growth-focused, investor-backed companies |

The sections below walk through each structure in detail so you can compare them side by side.

What is a sole proprietorship

A sole proprietorship is the simplest business structure available. If you start selling products or services without filing any paperwork with your state, you're automatically operating as a sole proprietor. There's no legal line between you and your business—you are the business.

All your business income goes directly on your personal tax return, which keeps things simple at tax time. However, this also means you're personally on the hook for every business debt and legal claim. If someone sues your business or you can't pay a supplier, your personal bank account, car, and even your home could be at risk.

- Pros: Easy to start, full control, minimal paperwork, simple tax filing

- Cons: No liability protection, harder to raise capital, business ends when you stop

Sole proprietorships work well for freelancers, consultants, or anyone testing a business idea before committing to something more formal.

What is a partnership

A partnership forms when two or more people agree to run a business together. You share profits, losses, and management responsibilities based on whatever terms you set in a partnership agreement. The business itself doesn't pay income tax—instead, each partner reports their share on their personal return.

Partnerships come in a few different forms, and the type you choose affects how much personal risk each partner takes on.

General partnership

In a general partnership, all partners share equal responsibility for running the business and equal exposure to its debts. Here's the catch: each partner can be held personally liable for the full amount of business obligations, even debts created by another partner's decisions.

Limited partnership

A limited partnership (LP) splits partners into two groups. General partners manage day-to-day operations and carry unlimited personal liability. Limited partners contribute money but stay out of management decisions, and their liability stops at whatever they invested.

Limited liability partnership

A limited liability partnership (LLP) protects all partners from personal liability for another partner's mistakes or misconduct. This structure is popular among professional services firms like law practices and accounting firms, where one partner's error could otherwise expose everyone.

What is a limited liability company

An LLC combines the liability protection of a corporation with the tax simplicity of a partnership. Your personal assets—your house, savings, car—are generally shielded from business debts and lawsuits. At the same time, profits pass through to your personal tax return by default, so you avoid the double taxation that corporations face.

LLCs offer flexibility in how you run things. You can manage the business yourself (member-managed) or appoint someone else to handle operations (manager-managed). You can also choose how you want to be taxed—stick with the default pass-through treatment, or elect to be taxed as an S corp or C corp if that works better for your situation.

- Ownership: Members (not shareholders) own the LLC

- Management: Member-managed or manager-managed, your choice

- Taxation: Pass-through by default, with options to elect corporate treatment

- Compliance: File Articles of Organization with your state and create an Operating Agreement

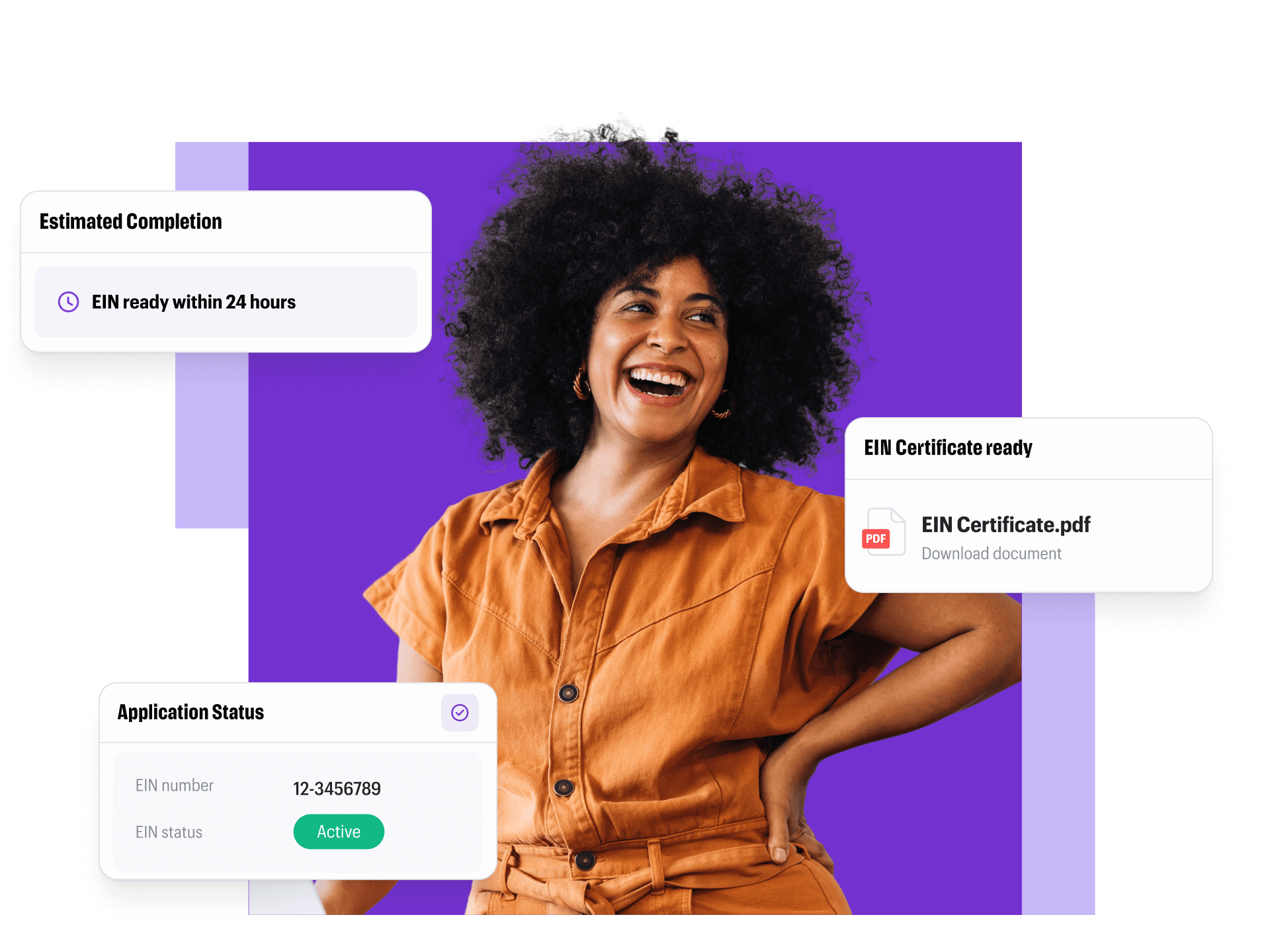

Forming an LLC involves filing paperwork with your state and designating a registered agent to receive legal documents on your behalf. Platforms like BizUpUSA walk you through each step and keep your compliance organized in one place.

Types of corporations

Corporations are more complex structures that exist as completely separate legal entities from their owners. They offer the strongest liability protection available, but they also come with more formalities—board meetings, corporate minutes, and detailed record-keeping.

C corporation

A C corp is the standard corporate structure. There's no limit on how many shareholders you can have or who those shareholders can be. The trade-off is double taxation: the corporation pays tax on its profits, and then shareholders pay tax again on any dividends they receive.

Despite the tax complexity, C corps are the go-to choice for startups seeking venture capital. They can issue multiple classes of stock and have no restrictions on investor types, which makes them attractive to institutional investors.

S corporation

An S corp isn't actually a separate type of entity—it's a tax election. By filing Form 2553 with the IRS, a corporation (or LLC) can pass income directly to shareholders' personal returns, avoiding double taxation.

The restrictions? S corps are limited to 100 shareholders, and all shareholders have to be U.S. citizens or residents. You'll also need to run payroll and pay yourself a "reasonable salary" before taking additional profits as distributions.

Benefit corporation

A benefit corporation (sometimes called a B corp) is a for-profit entity that's legally required to consider social and environmental impact alongside profit. If your business has a mission beyond making money, this structure signals that commitment to customers, employees, and investors.

LLC vs sole proprietorship

If you're starting a business on your own, you're probably weighing these two options. The core difference comes down to liability protection and how others perceive your business.

| Factor | Sole Proprietorship | LLC |

|---|---|---|

| Liability protection | None | Yes |

| Formation process | None required | File with state |

| Tax filing | Schedule C on personal return | Flexible options |

| Business credibility | Lower | Higher |

| Ongoing requirements | Minimal | Annual reports, registered agent |

A sole proprietorship is faster to start—you can begin today without filing anything. An LLC takes a bit more effort upfront, but it creates a legal barrier between your business and personal finances. Many banks and clients also take LLCs more seriously when you're opening accounts or signing contracts.

S corp vs LLC

This comparison usually comes up when business owners start earning enough to think about self-employment taxes. Here's the key insight: an LLC can elect S corp tax treatment, so you're really comparing tax strategies rather than entity types.

With default LLC taxation, you pay self-employment tax (Social Security and Medicare) on all your profits. With S corp treatment, you pay yourself a salary (subject to payroll taxes) and take remaining profits as distributions (not subject to self-employment tax). The savings can add up, but you'll also have the added complexity of running payroll.

- LLC with default taxation: Simpler compliance, lower administrative burden, works well when profits are modest

- S corp election: Potential tax savings when profits are higher, requires running payroll and paying yourself a reasonable salary

The break-even point varies based on your income and expenses. Many accountants suggest considering S corp treatment once profits consistently exceed $40,000 to $50,000 annually, though your situation may differ.

Inc vs LLC vs corp

You'll often see "Inc." after a company name and wonder how it differs from an LLC. "Inc." simply means incorporated—it's a corporation. The real question is whether a corporation or LLC fits your goals better.

- Inc. / Corporation: Shareholders own the company, a board of directors oversees major decisions, and you'll follow corporate formalities like annual meetings and written resolutions

- LLC: Members own the company, management structure is flexible, and there are fewer ongoing formalities to maintain

Corporations require more ongoing paperwork and record-keeping. LLCs offer more flexibility in how you structure ownership and run day-to-day operations. If you're planning to raise money from venture capitalists or eventually go public, a corporation is typically the better fit. For most small businesses, an LLC provides solid protection with less hassle.

How to choose the right business structure

There's no single "best" structure—the right choice depends on your specific situation. Here are the key factors to weigh:

- Number of owners: Solo ventures often start as sole proprietorships or single-member LLCs; multiple owners may prefer partnerships or multi-member LLCs

- Liability concerns: Higher-risk businesses benefit from the protection of an LLC or corporation

- Tax goals: Consider self-employment taxes, pass-through vs. corporate taxation, and your projected income

- Growth plans: Seeking outside investors typically requires a corporation; staying small favors an LLC

- Industry norms: Some professions require specific structures, like professional LLCs (PLLCs) or LLPs

Talking with a tax professional helps you model the numbers for your specific situation. For common formation questions, BizUpUSA's Astra AI Copilot provides guidance tailored to your state and business type.

Start your business with the right formation structure

Choosing your business structure now saves time and money compared to restructuring later. Once you've decided, the next step is filing the right paperwork with your state and setting up systems to keep your business in good standing.

BizUpUSA simplifies LLC formation with step-by-step guidance, registered agent services, and a dashboard that keeps your documents and deadlines organized—starting at $0 plus state fees.

FAQs about business formation structures

Can you change your business structure after formation?

Yes, you can convert from one structure to another—like moving from a sole proprietorship to an LLC, or from an LLC to a corporation. The process involves filing paperwork with your state and may have tax implications, so consulting a professional before making the switch is a good idea.

How much does it cost to form each type of business structure?

Costs vary by state and structure. Sole proprietorships have minimal costs beyond local licenses. LLCs and corporations require state filing fees that typically range from under $100 to several hundred dollars, plus optional services like registered agents and expedited processing.

Do you need a lawyer to form a business?

No, you can form most business structures yourself or use an online formation service. That said, consulting an attorney is helpful for complex situations like multi-member operating agreements, specialized industries, or businesses with significant liability exposure.

What is the easiest business structure to form?

A sole proprietorship is the easiest since it requires no formal state registration—you simply start operating. Among formal structures, an LLC is the simplest, requiring only Articles of Organization filed with your state.

Which business structure is best for a single owner?

For most single owners, an LLC offers a solid balance of liability protection, tax flexibility, and simplicity. A sole proprietorship works for very low-risk or early-stage ventures where you're testing an idea before committing to formal registration.

How long does it take to form an LLC or corporation?

Formation time depends on your state. Some states process filings within a few business days, while others take several weeks. Expedited options are often available for an additional fee if you want faster turnaround.

SHARE